- Litecoin price has just defended a crucial support level at $121.

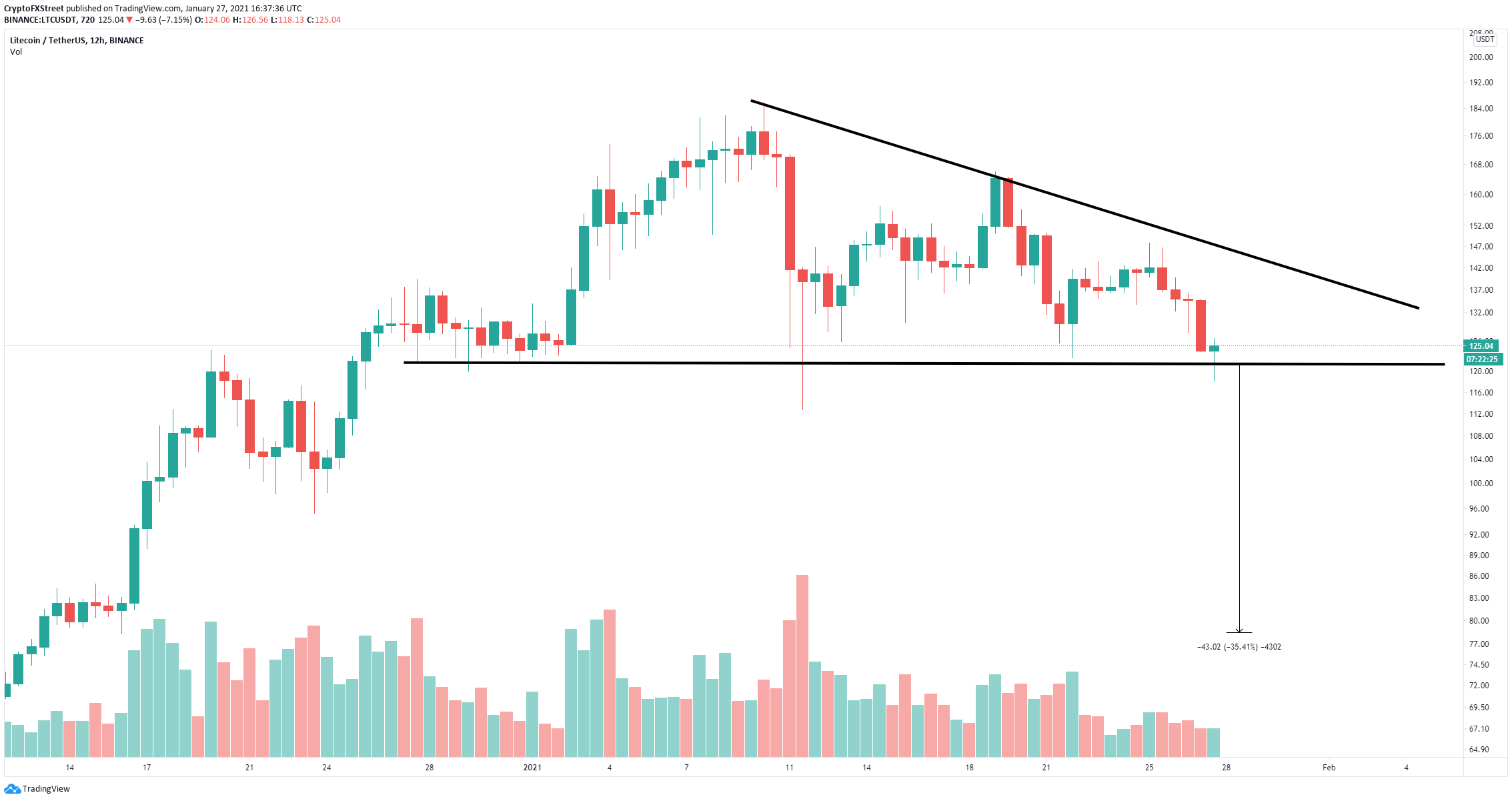

- The digital asset is trading inside a descending triangle pattern on the 12-hour chart.

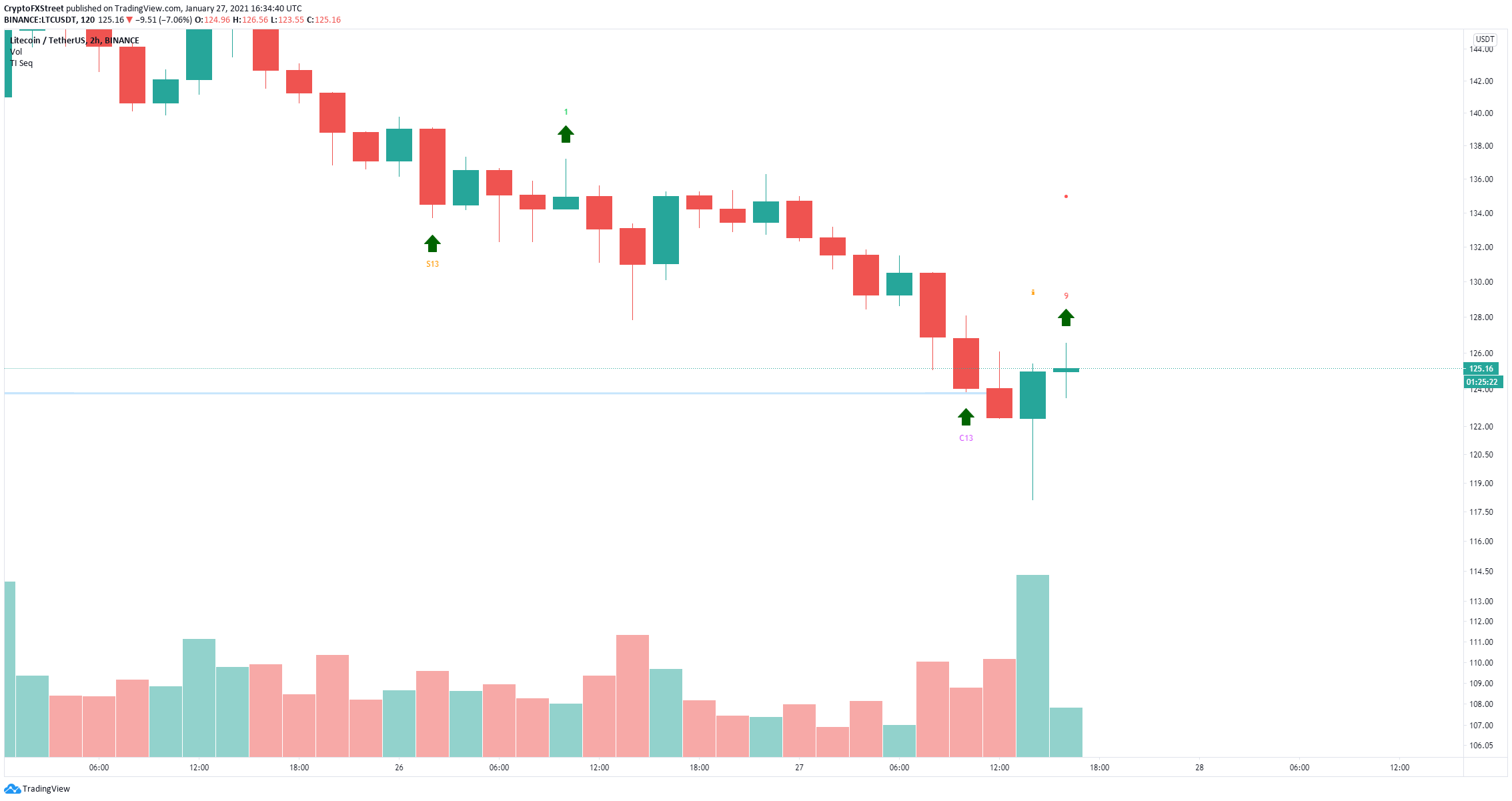

- The TD Sequential indicator has presented a buy signal that can help the bulls.

Litecoin has been trading sideways in a consolidation pattern after reaching its 2021 top at $185. LTC bulls are trying to defend a crucial support level and push Litecoin price towards $140.

Litecoin price can quickly rise to $140 with this rebound

On the 12-hour chart, Litecoin established a descending triangle pattern with a support trendline located at $121. It seems that bulls have defended this level once again and LTC price has rebounded by 6% in just two hours after touching $118.

LTC/USD 12-hour chart

This rebound could push Litecoin towards the upper trendline at $140. On the 2-hour chart, the TD Sequential indicator has just presented a buy signal giving credence to the bullish rebound.

LTC/USD 2-hour chart

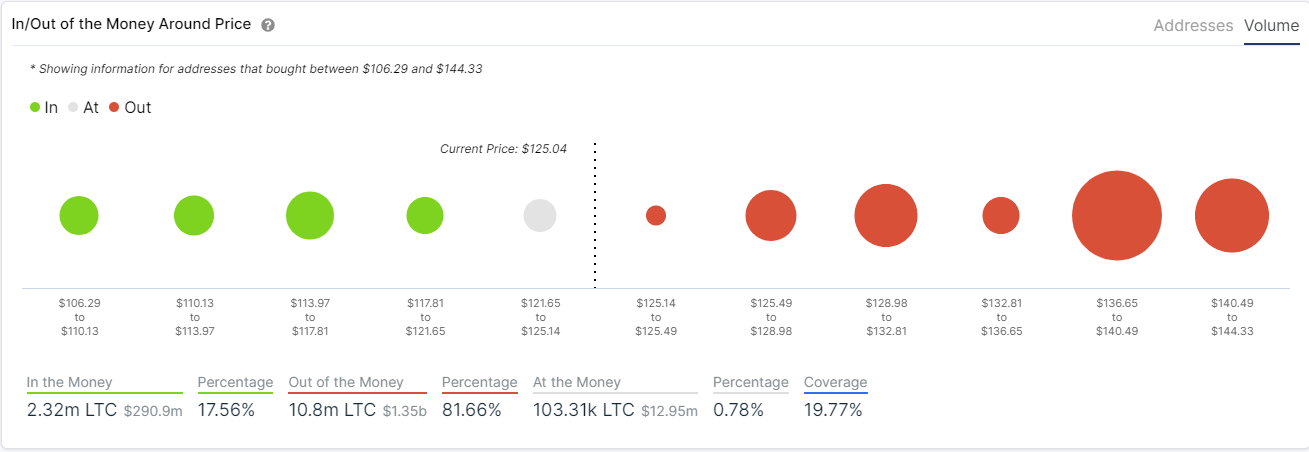

The In/Out of the Money Around Price (IOMAP) chart shows the most significant resistance area to be located between $136 and $140, which coincides with our price target above. In this area 4.8 million Litecoin was purchased by more than 104,000 addresses.

LTC IOMAP chart

However, the IOMAP model also indicates that support below $120 is scarce. A breakdown below $120 would be a bearish breakdown from the descending triangle pattern on the 12-hour chart with a price target of $78.

LTC/USD 12-hour chart

The Confluence Detector shows only one robust resistance level at $127 which coincides with the 50-SMA level on the daily chart. On the downside, there is support between $126 and $125.

LTC Confluence Levels

These two levels coincide with a previous high on the 4-hour chart, the 10-SMA on the hourly chart, the previous high on the 1-hour chart and finally the previous low in the 15-minutes chart.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH could see new all-time high in 2025 as blobs top burn leaderboard

Ethereum is down 1% on Tuesday following a weeklong consolidation of the general crypto market. The top altcoin could be set for a bullish 2025 if blobs continue their recent trend of burning high amounts of ETH.

PEPE Price Prediction: Last-minute $121M whale demand sparks 1,500% 2024 rally

PEPE price surged 25% within the last 24 hours, decoupling from the broader crypto market’s year-end volatility. With whales spotted entering last-minute buying frenzy, can PEPE breach the $0.000025 resistance?

XRP volumes zoom ahead of Bitcoin, Dogecoin in South Korea, what’s next?

XRP trading volumes on South Korea's biggest crypto exchanges have overtaken those of Bitcoin (BTC) and Ether (ETH) in a sign of flurried interest that often precedes price volatility.

Only three out of ten top altcoins grew in December

The cryptocurrency market continues to fall, losing some of its significant growth since the beginning of the year. Its capitalisation fell a further 1.4% to $3.23 trillion, matching the lows of the last week and a half.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.