- Ripple announced its RLUSD stablecoin will officially launch on Tuesday.

- RLUSD will go live on platforms including MoonPay, Uphold, CoinMENA, Bitso and ArchaxEx.

- XRP could rally to a new all-time high of $4.75 if it sustains a high volume above the $2.58 and $2.92 resistance levels.

Ripple (XRP) confirmed in a press release on Monday that its RLUSD stablecoin will officially launch on Tuesday across exchanges, including MoonPay, Uphold, CoinMENA, Bitso and ArchaxEx. Bullish sentiments surrounding the launch could help XRP overcome the $2.58 and $2.92 resistance levels.

RLUSD to go live on Tuesday following regulatory approval

Ripple's much anticipated USD-backed stablecoin is set to go live after a Monday announcement that RLUSD would launch globally on Tuesday.

The news comes after Ripple received approval from the New York Department of Financial Services (NYDFS) on December 10 to lauch the stablecoin, before which the crypto community had anticipated a December 4 launch.

Ripple stated that RLUSD is an "enterprise-grade, USD-denominated stablecoin created with trust, utility, and compliance at its core."

Ripple's president, Monica Long, noted in an X post on Monday:

The release of RLUSD marks a new chapter – both for the XRP Ledger, as well as @Ripple for use in our $70B+ payments flows. Combining our 10+ yrs in the business; the rigor & compliance required with stablecoin issuance by a @NYDFS chartered company; and an experienced Advisory…

— Monica Long (@MonicaLongSF) December 16, 2024

The stablecoin is intended to maintain a 1:1 peg with the US dollar, with reserves of US dollar deposits, short-term Treasury bonds and other liquid cash assets.

RLUSD will go live on exchanges, including MoonPay, Uphold, CoinMENA, Bitso and ArchaxEX. The company stated that it aims to launch the stablecoin on other platforms like Bullish, Bitstamp, Mercado Bitcoin and many others over the next few weeks.

Ripple also plans to use the stablecoin to initiate cross-border payments for its customers starting early next year.

Furthermore, RLUSD will initially be available on the XRP Ledger and Ethereum Mainnet for on-chain users to leverage across DeFi protocols.

Ripple added that an independent auditing firm will issue monthly attestations of RLUSD's reserve assets to ensure transparency.

Ripple's XRP validates bullish flag pattern following weekend's rise

XRP is up 1% after experiencing $18.62 million in liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long positions is $10.14 million, while short liquidations accounted for $8.48 million.

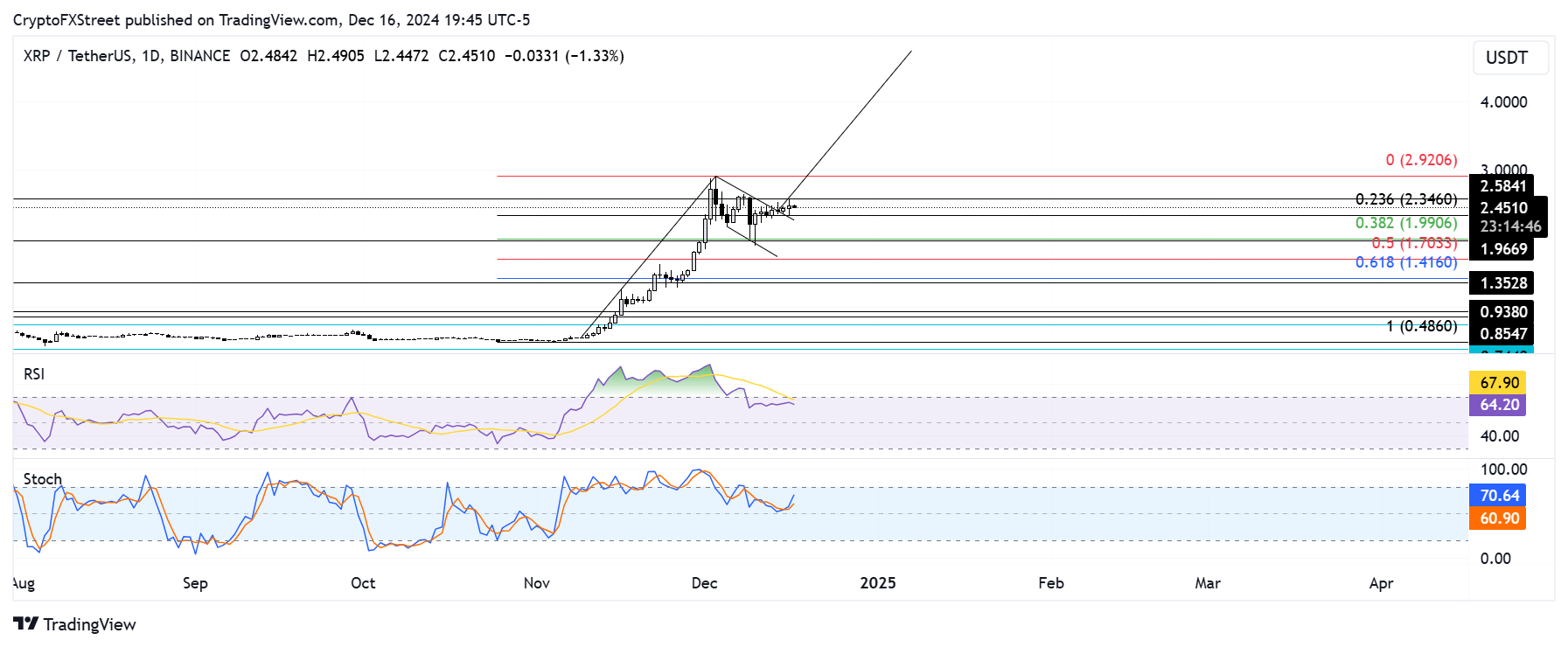

The remittance-based token validated a bullish flag pattern over the weekend with a breakout above the flag's descending trendline. XRP rallied further to test the resistance level at $2.58 on Monday after bouncing off the 23.6% Fibonacci Retracement level.

XRP/USDT daily chart

The maximum profit target from the pole's length indicates that XRP could hit a new all-time high of $4.75. A high volume move above the resistance levels at $2.58 and $2.92 could accelerate the rally to $4.75.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are above their neutral levels, indicating dominant bullish momentum.

A daily candlestick close below the support level at $1.96 will invalidate the thesis.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH could see new all-time high in 2025 as blobs top burn leaderboard

Ethereum is down 1% on Tuesday following a weeklong consolidation of the general crypto market. The top altcoin could be set for a bullish 2025 if blobs continue their recent trend of burning high amounts of ETH.

PEPE Price Prediction: Last-minute $121M whale demand sparks 1,500% 2024 rally

PEPE price surged 25% within the last 24 hours, decoupling from the broader crypto market’s year-end volatility. With whales spotted entering last-minute buying frenzy, can PEPE breach the $0.000025 resistance?

XRP volumes zoom ahead of Bitcoin, Dogecoin in South Korea, what’s next?

XRP trading volumes on South Korea's biggest crypto exchanges have overtaken those of Bitcoin (BTC) and Ether (ETH) in a sign of flurried interest that often precedes price volatility.

Only three out of ten top altcoins grew in December

The cryptocurrency market continues to fall, losing some of its significant growth since the beginning of the year. Its capitalisation fell a further 1.4% to $3.23 trillion, matching the lows of the last week and a half.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.