Incoming data is going to be more important than ever for the Fed and can easily be the excuse for the Fed to go on hold at the January meeting. This is clearly what the market expects, with 96.3% betting on no change, according to the CME FedWAtch tool. The meeting is scheduled for Jan 29. We don’t get the next PCE until Jan 31. The Fed can legitimately say it’s waiting for more data.

Today we get the usual Thursday jobless claims and tomorrow a bunch of inventory releases, but no notable market-movers. The Santa Claus rally is using up all the oxygen. We will soon get the data on holiday shopping, with all that implies for consumer confidence. So far we have Mastercard SpendingPulse, showing spending rose 3.8% between Nov 1 and Dec 24. And savvy shoppers are still waiting for the Jan sales.

The biggest worry is the unfolding of Trump policies in the next week as the crescendo builds to inauguration day and Day 1. Remember Trump said he would end the Ukraine war on Day 1, a huge worry for the Ukrainians, but Mr. Putin is standing back. Let’s just note that if the war really is ended, sanctions on Russia can be lifted not that long afterwards and presumably the price of oil can fall some more.

A background worry is a cyber-attack on a Japanese airline. We suspect many more cyber-attacks are occurring that we don’t hear about. We have brutal terrorism and war killings in various places (Pakistan attacked the Taliban—huh?). but cyber is the new war.

Forecast: As expected, the euro/dollar is stuck in the mud and because the next holiday, New Year’s day, comes next Wednesday, we may have to wait until a whole week for the new year and something interesting. Normally we would expect the big names to pare positions before then, meaning the euro could actually get a rise by default. The last time we had a bounce, it rose above the 200-day. This time the 200-day lies at 1.0483. The max is presumably the B band top at 1.0556—the worst-case scenario.

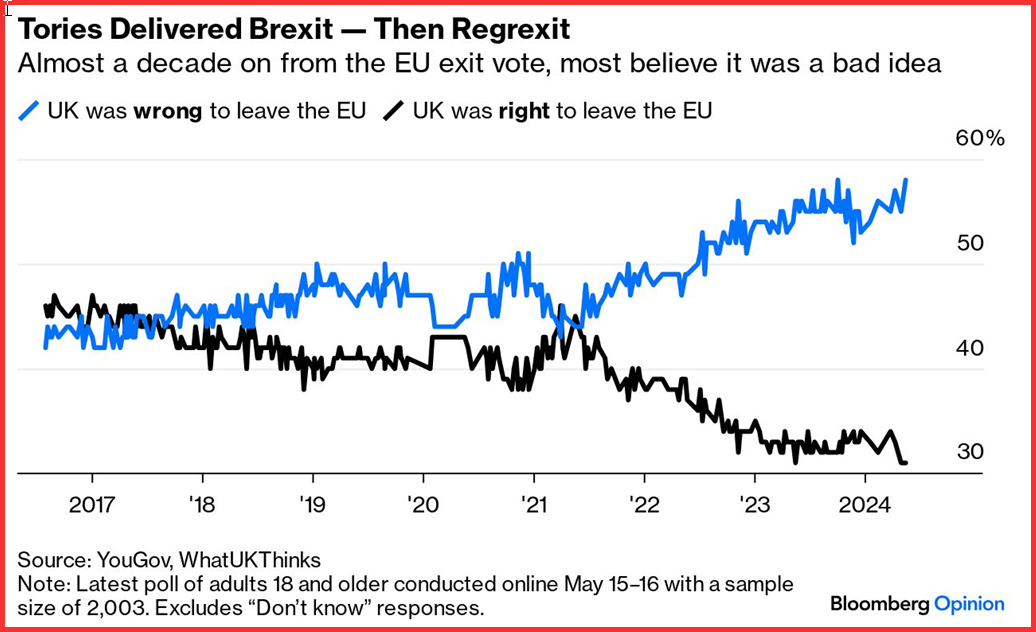

Political tidbit: Most year-end commentary is not worth the time and energy. But we like his chart from Bloomberg. No further comment necessary.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD extends slide toward 1.0300, touches new two-year low

EUR/USD stays under bearish pressure and trades at its lowest level since December 2022 below 1.0350 on Thursday. The pair turned south amid a resurgent US Dollar demand and worsening market mood. Investors stay cautious at the onset of 2025, awaiting the US jobs data for fresh incentives.

GBP/USD slumps to multi-month lows below 1.2450

Following an earlier recovery attempt, GBP/USD reversed its direction and declined to its weakest level in nearly eight months below 1.2450. The renewed US Dollar (USD) strength on worsening risk mood weighs on the pair as markets await mid-tier data releases.

Gold benefits from risk aversion, climbs above $2,640

Gold gathers recovery momentum and trades at a two-week-high above $2,640 heading into the American session on Thursday. The precious metal benefits from the sour market mood and the pullback seen in the US Treasury bond yields.

XRP rockets 11% as Bitcoin starts New Year with bullish bang

Crypto majors zoomed higher in the past 24 hours as the market entered a widely expected bullish year, with Bitcoin inching above $95,000 to shake off losses from last week. XRP surged 11% to lead growth among majors as of Thursday, led by $1.3 billion worth of trading volumes on Korea-focused exchange UpBit.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.