- Gold Price portrays corrective bounce at one-week low amid lackluster markets.

- Broad US Dollar strength, risk aversion prod XAU/USD rebound from key support confluence.

- Hawkish Fed talks, concerns about US economic strength keep Gold sellers hopeful of breaking immediate support.

Gold Price (XAU/USD) struggles to defend the first daily gains in six at the lowest level in more than a week as market players seek additional clues to defend the previous bearish bias about the bullion. In doing so, the XAU/USD traders reassess the latest United States (US) data and Federal Reserve (Fed) clues amid hopes of witnessing a soft landing in the US despite higher rates. The same joins fears of economic slowdown in other major countries to propel the Greenback and exert downside pressure on the Gold Price.

Elsewhere, grim concerns about China, one of the world’s biggest Gold customers, join the Sino-American tussles and upbeat yields to also increase the hardships for the XAU/USD recovery.

That said, a one-week-long European Central Bank (ECB) policymakers’ blackout period and a likely improvement in the second-tier US employment clues seem to highlight today’s Fed talks as the key catalysts.

Also read: Gold Price Forecast: XAU/USD could test $1,900 if key support confluence fails

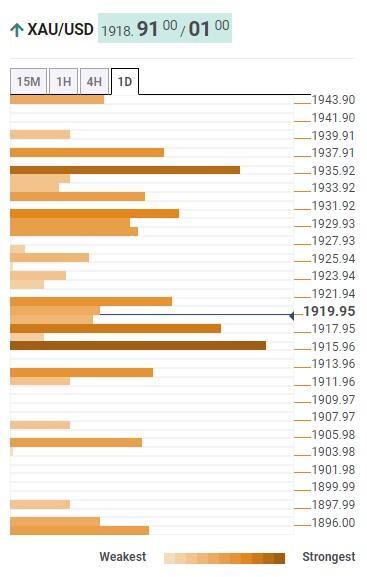

Gold Price: Key levels to watch

Our Technical Confluence indicator suggests that the Gold Price prods the lower end of the short-term trading range while fading the bearish bias after five-day losing streak. That said, the XAU/USD remains within a strong trading range between $1,935 and $1,915 despite falling in recent days.

That said, the middle band of the Bollinger on one-day joins Fibonacci 38.2% on one-month to highlight $1,915 as the key support.

On the contrary, Fibonacci 61.8% on one-month suggests the $1,935 is an important upside hurdle for the buyers.

It should be noted that the middle band of the Bollinger on four-hour (4H) joins the 50-DMA to highlight $1,930-31 as an extra filter towards the north.

In the same way, the 200-DMA joins the Pivot Point one-week S1 and Fibonacci 23.6% on one-day to signal $1,918 as immediate support.

It’s worth observing that the Fibonacci 38.2% on one-week and 161.8% on one-day also acts as an upside filter near $1,938 before directing the Gold buyers toward the $1,950 hurdle.

Meanwhile, Fibonacci 23.6% on one-month prods the XAU/USD sellers near $1,905 before directing them to the Pivot Point one-week S2 and one-month S1, around $1,895.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends slide toward 1.0300, touches new two-year low

EUR/USD stays under bearish pressure and trades at its lowest level since December 2022 below 1.0350 on Thursday. The pair turned south amid a resurgent US Dollar demand and worsening market mood. Investors stay cautious at the onset of 2025, awaiting the US jobs data for fresh incentives.

GBP/USD slumps to multi-month lows below 1.2450

Following an earlier recovery attempt, GBP/USD reversed its direction and declined to its weakest level in nearly eight months below 1.2450. The renewed US Dollar (USD) strength on worsening risk mood weighs on the pair as markets await mid-tier data releases.

Gold benefits from risk aversion, climbs above $2,640

Gold gathers recovery momentum and trades at a two-week-high above $2,640 heading into the American session on Thursday. The precious metal benefits from the sour market mood and the pullback seen in the US Treasury bond yields.

XRP rockets 11% as Bitcoin starts New Year with bullish bang

Crypto majors zoomed higher in the past 24 hours as the market entered a widely expected bullish year, with Bitcoin inching above $95,000 to shake off losses from last week. XRP surged 11% to lead growth among majors as of Thursday, led by $1.3 billion worth of trading volumes on Korea-focused exchange UpBit.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.