Intraday trading isn't just for quick thinkers—and that's a good thing.

Because intraday offers:

- Frequent opportunity.

- Less competition.

- Low-risk trades.

What looks like 'fast thinking and reaction times'—in how I trade—is anything but.

Keep reading to see how intraday trading and slow thinking synergise when paired with a framework of robust principles.

Process not speed

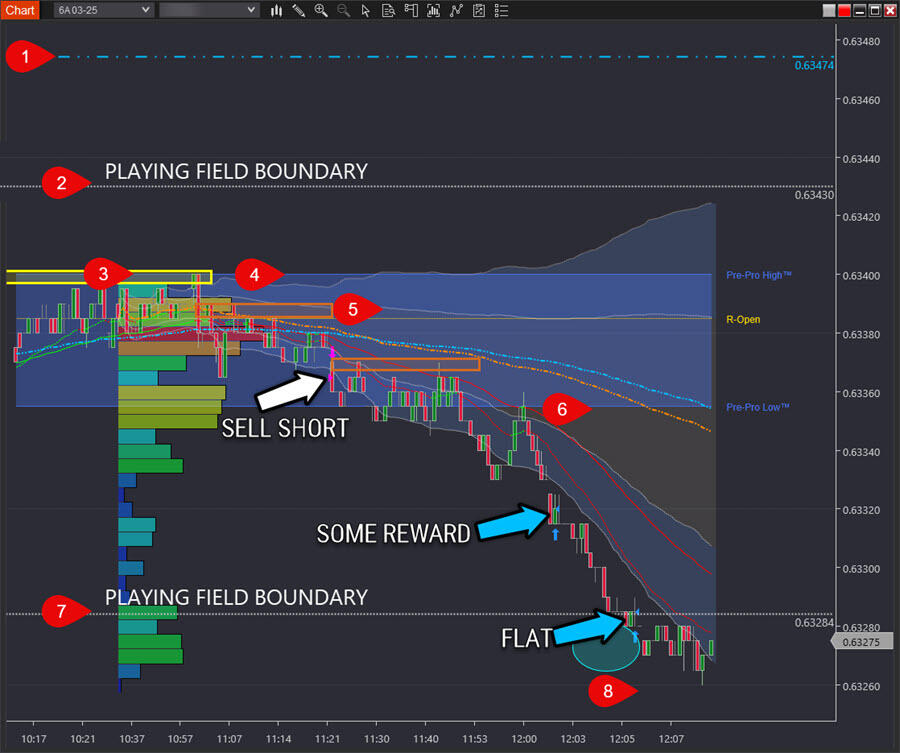

Slow-thinkers show strength in creative problem-solving and analytical reasoning. Take the first trade of the day shown below:

Like a sports match played within specific dimensions, the trade is the by-product of analysing your 'playing field', directing you on where you can and can't trade.

Once you know your playing field, this framework extends to:

- Who's going to move the price?

- Why will they move the price?

- Where will they move the price to?

This approach suits the complexity and nuances of markets yet reduces them to a robust system you become familiar with.

Systems exist to achieve consistency. Through repetition, they make the complex straightforward.

Anticipation not reaction

Knowing where and why you'll trade before 'trading time' starts, you avoid the mental stress of needing to react instantly.

Instead, your entry is calm and measured because you anticipated this moment long ago.

But before you pounce:

You first want to know what price route your trade is taking.

Price regularly takes different routes as it travels from one price level to another. And it's these different routes that cause you havoc, whether it be through:

- Overtrading.

- Exiting at the wrong times.

- Losses instead of profits.

But there's a solution professional traders swear by—a collection of maps for different price routes—in the form of signature trades that give you clear directions.

Imagine you're driving to the local shop—a trip you make every week. Thanks to repetition, you don't need Google Maps because you know the route from memory.

Signature trades work in the same way. Through repetition, you know your trade directions by heart.

Mental shortcuts to acting quickly

Did you know your brain processes visuals such as colours and simple shapes 60,000 times faster than text?

A key principle of how I trade is to base decisions on 'multiple points of evidence'. As Dr Brett Steenbarger says: "If everyone engaged in evidence-based trading, there would be no overtrading."

Zoom out on the trade from above, and you will see a reference to eight different simple coloured shapes and lines. Each represents a key piece of evidence.

Putting the meaning of each evidence piece into words would take several sentences. Add all eight pieces, and you’ll have pages of notes.

Add the additional evidence shown but not numbered, and the details can fill an entire chapter of a novel.

But when the information is presented visually, you can comprehend a whole chapter in an instant.

Anyone in a mentorship relationship with me knows I’m meticulous about sticking to the designated colour key—because it's just so damn powerful.

At 60,000 times faster comprehension, consider how significant your advantage over so many of the traders competing to get paid is.

Combine this with signature trades, and you have a powerful trading system that doesn’t rely on fast thinking or quick reflexes.

Slow-thinkers kryptonite

The one thing you don't do as a slow-thinker is get out of your lane. That's when things come unstuck.

If you are experiencing a moment in the market that's not something you've done numerous times before, you can't think fast enough to adapt.

But relying on a playbook of signature trades insulates you against doing this.

Your most important asset? Energy

You may relate to not having the same 'staying power' you did in my 30's.

Trading as you age requires a mindset shift: time is no longer your most valuable asset—it's energy.

With robust principles and a playbook of income-producing trades, your trading business maximises your output efficiently.

In summary

Slower thinkers tend to steer towards reflection—one of the most potent techniques for deep learning.

It could be while walking the dog during a break from the screens (There's a point of evidence that tells you when to take a break).

A sophisticated endeavour like trading becomes simple when you rely on intelligent principles, signature trades and mental shortcuts.

Simple doesn't mean instant. But what you can repeat, you can master. Agree?

Repeatedly apply the framework and principles discussed, and each trading day, you win where you've won before.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD extends slide toward 1.0300, touches new two-year low

EUR/USD stays under bearish pressure and trades at its lowest level since December 2022 below 1.0350 on Thursday. The pair turned south amid a resurgent US Dollar demand and worsening market mood. Investors stay cautious at the onset of 2025, awaiting the US jobs data for fresh incentives.

GBP/USD slumps to multi-month lows below 1.2450

Following an earlier recovery attempt, GBP/USD reversed its direction and declined to its weakest level in nearly eight months below 1.2450. The renewed US Dollar (USD) strength on worsening risk mood weighs on the pair as markets await mid-tier data releases.

Gold benefits from risk aversion, climbs above $2,640

Gold gathers recovery momentum and trades at a two-week-high above $2,640 heading into the American session on Thursday. The precious metal benefits from the sour market mood and the pullback seen in the US Treasury bond yields.

XRP rockets 11% as Bitcoin starts New Year with bullish bang

Crypto majors zoomed higher in the past 24 hours as the market entered a widely expected bullish year, with Bitcoin inching above $95,000 to shake off losses from last week. XRP surged 11% to lead growth among majors as of Thursday, led by $1.3 billion worth of trading volumes on Korea-focused exchange UpBit.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.