Turning points ahead

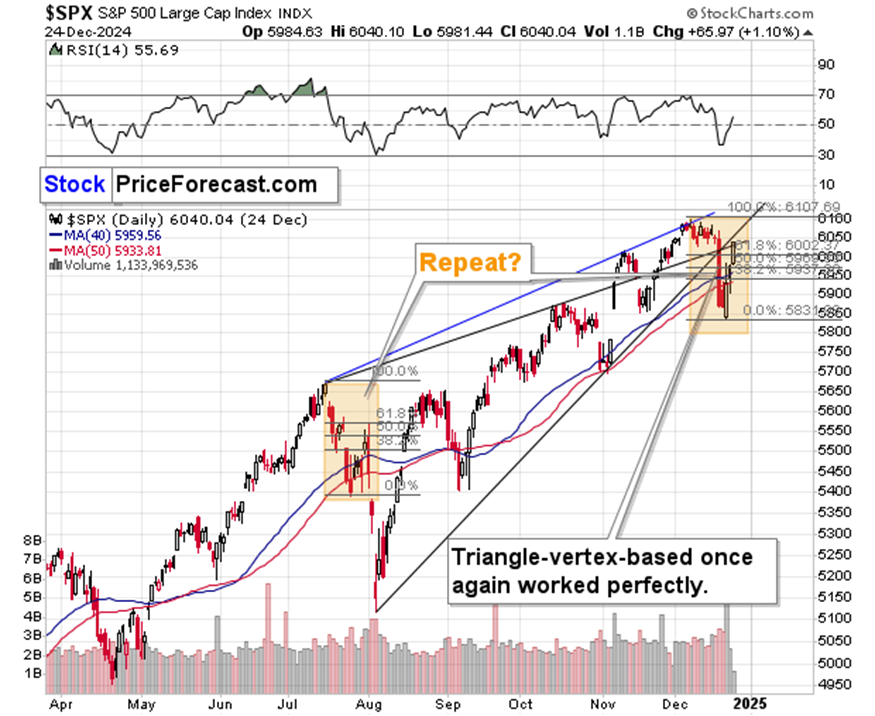

So far, this week has been calm. However, as you read in my previous analysis, the turning points are near and All three of the assets where we have short positions have paused recently, and since it happened after a sizable move lower, it’s a completely natural phenomenon.

In the case of the FCX, it’s after a breakdown below the head and shoulders pattern, which means that the current tiny move us is perfectly in tune with the likely post-H&S pattern action, and it only confirms the very bearish outlook.

In the case of the GDXJ (and GDX), we see the back-forth movement is taking place below their November lows, which means that the breakdown below them was just verified.

In the case of the [new asset where we have a profitable short position], we have the same thing, with the additional note that it is much weaker as it fell well below its November lows and currently didn’t manage to move closer to them.

Also, please note that all the above is happening (or actually, not happening), while the general stock market moved higher recently.

This means that all the above-mentioned shares are NOT following stocks higher right after they DID follow them lower, magnifying their declines. This is a confirmation that we correctly chose the proxies to profit from the declines in in stocks and in the precious metals sector.

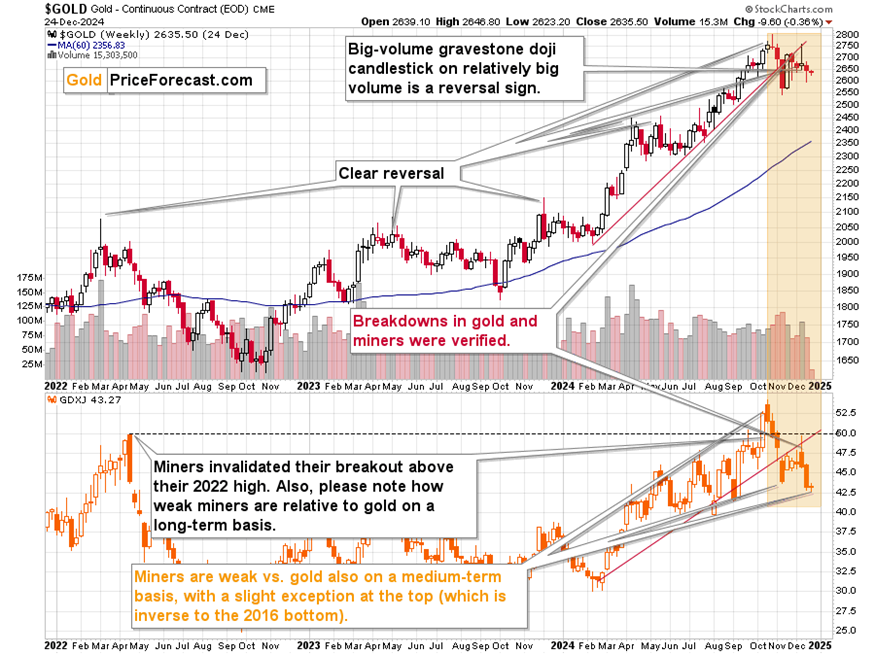

Having said that, I think it would be a good time to revisit the weekly chart (based on weekly candlesticks) featuring gold and GDXJ to put things into perspective. It’s just one chart, but it’s very rich in signs and clues.

Impending move lower

All right, where do we begin…

Let’s start with the breakdowns. Both: gold and GDXJ broke below their rising red support lines. It wouldn’t be as important as it is if it wasn’t for the verifications of those breakdowns. In both cases, we saw prices move back to the rising support lines, verifying them as resistance and then declining once again. This is a powerful indication that the trend changed and it’s now down.

Another clue is the general underperformance of mining stocks compared to gold. It’s obvious even at the first sight – while gold is hundreds of dollars above its 2022 high, miners just invalidated their move above it. On a short-term basis, we see that miners broke below their November lows, while gold didn’t do so (yet).

This is a sign suggesting that:

-

The entire precious metals sector is likely to move lower.

-

Miners are likely to move MUCH lower when gold declines.

This might also mean that some people might prefer a strategy where they own gold (and perhaps make passive income on it), but short mining stocks to hedge the above position (just my opinion, not investment advice).

One interesting thing is that miners moved up strongly relative to gold right at their top. This is a very specific exception from the rule that confirms it that is known to few. Namely, miners are weak before the trend changes, but right before that happens their volatility increases once again. We saw that at the 2016 bottom, where miners were first strong and held up well, but when they finally broke to new lows it was a bear trap.

What we saw at this year’s top was likely a bull trap.

The next thing is the way in which gold topped recently and at the yearly top. In both cases, it was a clear reversal. This meant tops multiple times in the past, and I marked that on the chart. Moreover, the most recent reversal took place on a relatively big volume, which confirmed the bearish outlook.

So yes, a bigger move lower is coming in the case of the precious metals market and GDXJ and [new asset where we have a short position] (and FCX, due to its own reasons) are poised to decline profoundly based on it. The first targets are as I’ve been outlining them, but it’s likely that all they will manage to do is to trigger a correction, not a new big rally.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD extends slide toward 1.0300, touches new two-year low

EUR/USD stays under bearish pressure and trades at its lowest level since December 2022 below 1.0350 on Thursday. The pair turned south amid a resurgent US Dollar demand and worsening market mood. Investors stay cautious at the onset of 2025, awaiting the US jobs data for fresh incentives.

GBP/USD slumps to multi-month lows below 1.2450

Following an earlier recovery attempt, GBP/USD reversed its direction and declined to its weakest level in nearly eight months below 1.2450. The renewed US Dollar (USD) strength on worsening risk mood weighs on the pair as markets await mid-tier data releases.

Gold benefits from risk aversion, climbs above $2,640

Gold gathers recovery momentum and trades at a two-week-high above $2,640 heading into the American session on Thursday. The precious metal benefits from the sour market mood and the pullback seen in the US Treasury bond yields.

XRP rockets 11% as Bitcoin starts New Year with bullish bang

Crypto majors zoomed higher in the past 24 hours as the market entered a widely expected bullish year, with Bitcoin inching above $95,000 to shake off losses from last week. XRP surged 11% to lead growth among majors as of Thursday, led by $1.3 billion worth of trading volumes on Korea-focused exchange UpBit.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.