- Litecoin price hit a new weekly peak of $130 on Tuesday, up 35% since December 10.

- The LTC rally has coincided with an $18 million buying spree among LTC miners.

- Technical indicators suggest LTC price could reach $150 before hitting the next major resistance cluster.

Litecoin price traded as high as $131 on Binance on Tuesday, rising 35% within the weekly time frame. On-chain data trends suggest an ongoing acquisition trend among LTC miners could propel the rally further.

Litecoin price spikes 30% ahead of US Fed decision

On Tuesday, Bitcoin price rose to a new all-time high of $108,135, driving up prices of top altcoins including Litecoin (LTC), Solana (SOL) and Ripple (XRP).

Based on current market reports, the rally can be attributed to investors placing last-minute bullish bets as the US Federal Open Market Committee (FOMC) meeting kicked off in New York.

Litecoin price action, December 17 | LTCUSDT (Binance)

Litecoin price action, December 17 | LTCUSDT (Binance)

The chart above shows how Litecoin price rose as high as $131.50 on Binance exchange, while BTC advanced to new global peaks.

Zooming out, LTC’s latest price surge brings its weekly time frame gains to above the 30% mark.

This reflects that Litecoin market momentum has been predominantly bullish since the crypto market recovered from the abrupt market crash observed on December 10.

Miners acquire $18M LTC over the past week

While the crypto market has been on the uptrend over the past week, Litecoin price has outperformed rival Layer-1 altcoins like Ethereum (ETH), Cardano (ADA) and Solana (SOL).

On-chain data shows that a rare accumulation trend observed among Proof-of-Stake miners has contributed to Litecoin’s outsized 30% gain.

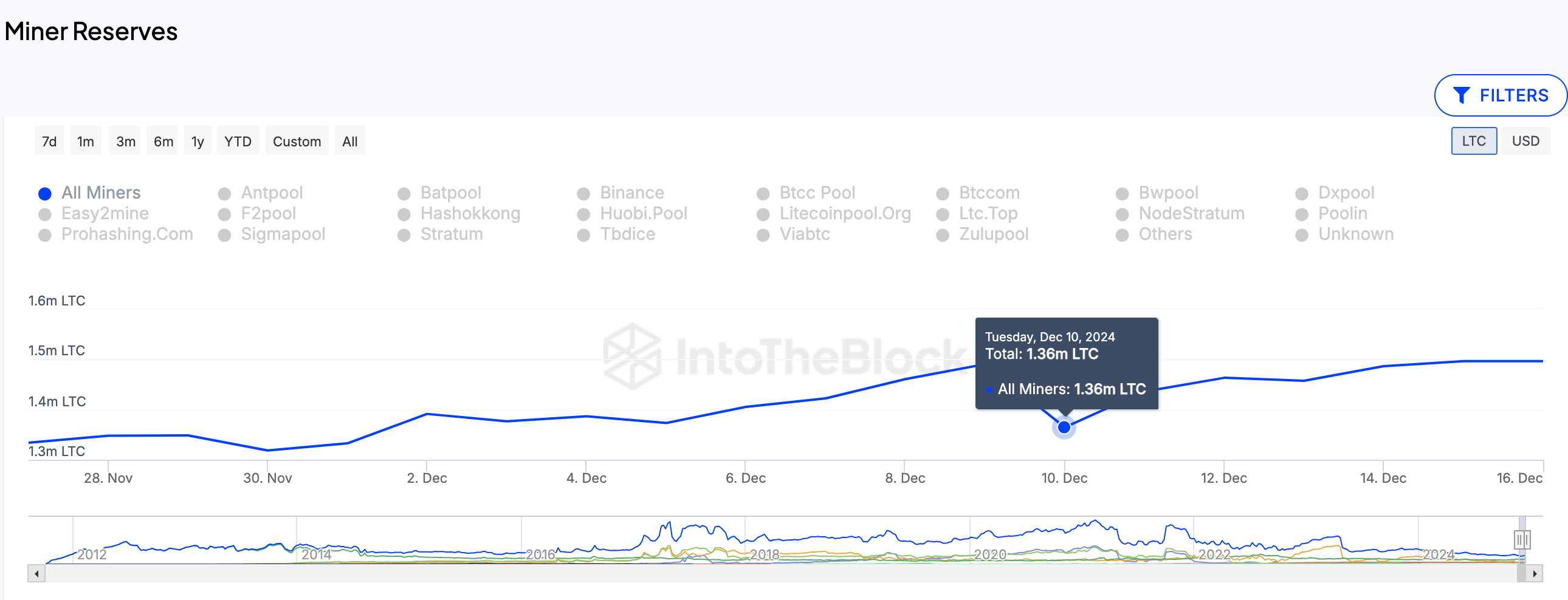

In affirmation of this stance, the IntoTheBlock chart below shows real-time changes in LTC miners’ reserve balances.

This provides real-time insights into LTC miners’ trading activity around key market cycles.

Litecoin Miners Reserves | IntoTheBlock

Litecoin Miners Reserves | IntoTheBlock

The chart above shows that the miners held only 1.36 million LTC in their cumulative balances as of December 10.

But since then, the miners flipped into accumulation mode, acquiring 140,000 LTC over the past one week to bring their current balances to 1.5 million LTC at close of December 16.

Valued at the current prices, the miners have effectively acquired LTC coins worth $17.7 million between December 10 and December 17, coinciding with the 30% price rally.

Such large acquisitions by miners often heighten bullish momentum for two key reasons.

First, by preventing newly-issued block rewards from entering the market supply, upward pressure intensifies during periods of high demand, as observed when the FOMC meeting kicked off on Wednesday.

More so, miners are highly influential stakeholders within any Proof-of-Work blockchain ecosystem.

Hence when miners take a bullish stance as shown by the $18 million acquisition over the past week, other retail traders and prospective market entrants could be incentivized to follow suit.

If the current market dynamics persist, LTC price could be on the verge of another major leg-up in the days ahead.

Litecoin Price Forecast: LTC Set for $150 Breakout if This Happens

The ongoing Litecoin (LTC) pricee rally has aligned with significant miner accumulation and a surge in trading volume, creating a bullish setup for further upside.

Between December 10 and December 17, miners accumulated $18 million worth of LTC while the price surged 35%. This prevented new supply from flooding the market, intensifying upward momentum during the Federal Reserve’s FOMC-driven sentiment boost.

Analyzing the chart, LTC price is currently testing the upper boundary of a consolidation phase near $127. A clear breakout above this resistance could trigger a run towards $135 and subsequently $150, fueled by increasing bullish momentum and heightened Volume Delta.

Litecoin Price Forecast | LTCUSDT

Litecoin Price Forecast | LTCUSDT

The notable volume spike seen on December 18 signals growing market conviction among buyers, which could propel the rally further if sustained.

On the downside, critical support lies at $118, aligned with the Donchian Channel median. A breakdown below this level would invalidate the bullish outlook, potentially causing LTC to retrace toward the $100.56 support zone.

In summary, a multi-day close above $127 could set the stage for LTC to test $150 in the coming trading sessions.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH could see new all-time high in 2025 as blobs top burn leaderboard

Ethereum is down 1% on Tuesday following a weeklong consolidation of the general crypto market. The top altcoin could be set for a bullish 2025 if blobs continue their recent trend of burning high amounts of ETH.

PEPE Price Prediction: Last-minute $121M whale demand sparks 1,500% 2024 rally

PEPE price surged 25% within the last 24 hours, decoupling from the broader crypto market’s year-end volatility. With whales spotted entering last-minute buying frenzy, can PEPE breach the $0.000025 resistance?

XRP volumes zoom ahead of Bitcoin, Dogecoin in South Korea, what’s next?

XRP trading volumes on South Korea's biggest crypto exchanges have overtaken those of Bitcoin (BTC) and Ether (ETH) in a sign of flurried interest that often precedes price volatility.

Only three out of ten top altcoins grew in December

The cryptocurrency market continues to fall, losing some of its significant growth since the beginning of the year. Its capitalisation fell a further 1.4% to $3.23 trillion, matching the lows of the last week and a half.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.