Chaos Clinic for 5/1/2020

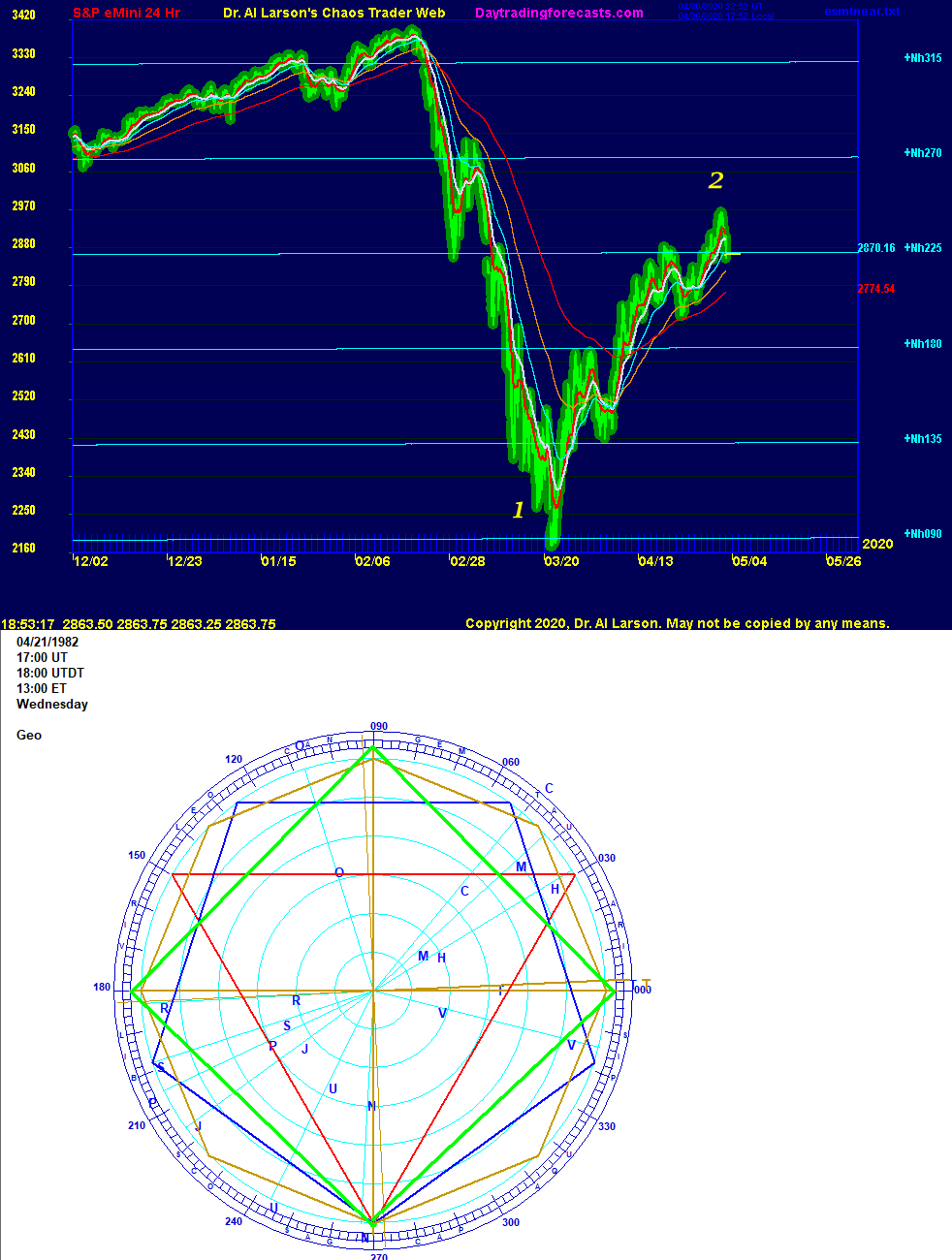

The top chart shows a plasma chart of the S&P, overlayed with heliocentric Neptune flux lines.

The flux lines are plotted every 45 degrees using a Wheel of 1800 scale. This scale is 5 times the Wheel of 360 scale that existed before COVID-19.

Markets have a "fractal fuzziness." Underlying that is a harmonic structure based on integer ratios. This shows up in this chart in the retracement ratios. The move 2 retracement was .642, a bit beyond the Fibonacci .618.

But in terms of the Neptune levels, the decline was down 5, up 3, the ratio of two integers, 3 and 5. The Fibonacci series is a seriesof intergers, starting with 1,2,3,5, and 8. So a a 3:5 ration fits. Energy adds together in integer ratios.

So why would Neptune electric field flux show up so strongly in the S&P? The answer is in the second chart, which is a natal ephemeris wheel for the S&P.

Neptune is very near the cardinal 270 degree position. Using this as a common point, there are harmonic relationships with several other natal planets.

Natal Sun is trine natal Neptune (red). Mars and Moon are square to it (green). Venus, Chiron, and Saturn are pentile to Neptune (blue). And Mercury is octile to Neptune. This octile creates frequency doubling with the square. Frequency doubling is a precursor to Chaos.

On the top chart, the Nh+315 level is 180 degrees to natal Mercury. The low of Nh+090 is natal Moon. The current Nh+225 is Mh+090. The intermediate level of bNh+135 is Mh+000, while the Nh+180 is both Tn+090 and Rn+270. So with the help of the plasma chart, which helps show the "fractal fuzz" and the ephemeris, the harmonic structure underlying the chaos is revealed.

The top chart looes like moves 1 and 2 of 7 in a down Chaos Clamshell.

This content was published on Dr. Al Larson's Chaos Clinic which you can attend each Friday for free.

Dr. Al Larson has developed a complete Chaos Model of Markets, four unique courses that let you become a Certified Chaos Trader, some very unique eMylar fractal pattern overlays, and tools that permit forecasting individual stocks and markets years in advance. You can also sign up for a free weekly email, and attend a free Chaos Clinic on Fridays. To learn more, click on the author's profile.

Be sure to sign up for the free weekly email!

Information on this page contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these securities. You should do your own thorough research before making any investment decisions.

Recommended Content

Editors’ Picks

EUR/USD extends slide toward 1.0300, touches new two-year low

EUR/USD stays under bearish pressure and trades at its lowest level since December 2022 below 1.0350 on Thursday. The pair turned south amid a resurgent US Dollar demand and worsening market mood. Investors stay cautious at the onset of 2025, awaiting the US jobs data for fresh incentives.

GBP/USD slumps to multi-month lows below 1.2450

Following an earlier recovery attempt, GBP/USD reversed its direction and declined to its weakest level in nearly eight months below 1.2450. The renewed US Dollar (USD) strength on worsening risk mood weighs on the pair as markets await mid-tier data releases.

Gold benefits from risk aversion, climbs above $2,640

Gold gathers recovery momentum and trades at a two-week-high above $2,640 heading into the American session on Thursday. The precious metal benefits from the sour market mood and the pullback seen in the US Treasury bond yields.

XRP rockets 11% as Bitcoin starts New Year with bullish bang

Crypto majors zoomed higher in the past 24 hours as the market entered a widely expected bullish year, with Bitcoin inching above $95,000 to shake off losses from last week. XRP surged 11% to lead growth among majors as of Thursday, led by $1.3 billion worth of trading volumes on Korea-focused exchange UpBit.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.