-

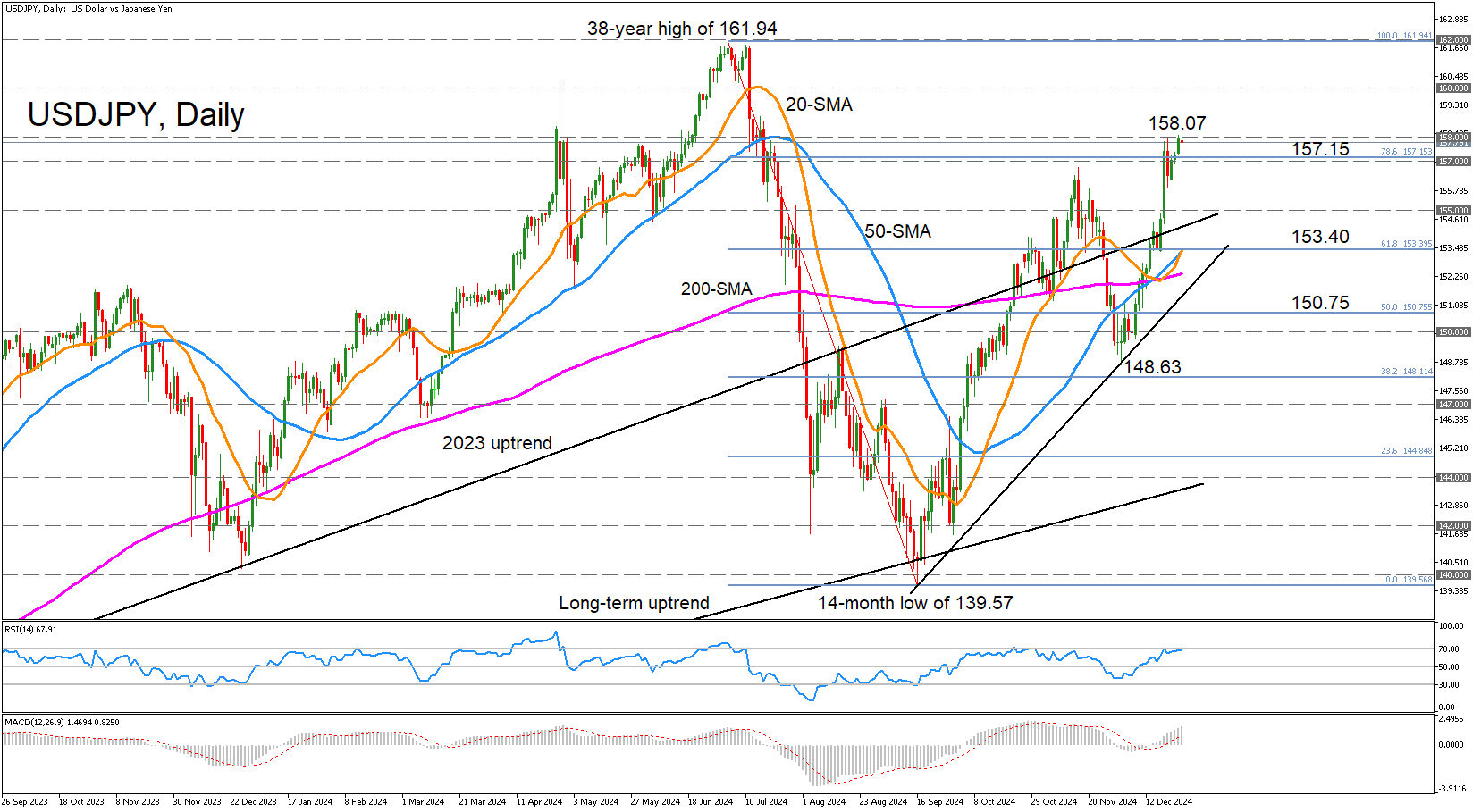

USD/JPY extends uptrend to 5-month highs, reaches 158.00.

-

But positive momentum may be waning.

USD/JPY crossed above the 158.00 mark on Thursday for the first time since July, but the price is trading slightly below that significant level on Friday. The RSI is reflecting the weaker upside momentum as it appears to be plateauing just below the 70 overbought area. But the MACD continues to climb higher and remains well above its red signal line.

The bulls would need to successfully overcome the resistance in the 158.00 region if the upside momentum is to strengthen or even last. A break above it would bring into focus the psychologically important 160.00 milestone, and an even more crucial level awaits at 162.00, where prices failed to breach it in early July. Nevertheless, rising above 162.00 would reinforce the pair’s long-term bullish outlook.

However, if the 158.00 resistance proves difficult to crack and the price reverses lower, there’s likely to be immediate support around the 78.6% Fibonacci retracement of the July-September downtrend at 157.15. A drop below it would bring into scope the 155.00 level, which acted as strong support during May and June. Further down, the 61.8% Fibonacci is another strong obstacle for the bears as it is being fortified by the 20- and 50-day simple moving average (SMA) in the 153.40 region.

Should the losses stretch all the way until the December low of 148.63, the bullish structure would come into question, at least in the medium term.

In brief, USDJPY faces a potentially tough battle at 158.00 and surpassing it is essential to maintaining the current bullish phase. Failure to do so would risk shifting the medium-term picture to a more neutral one.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD extends slide toward 1.0300, touches new two-year low

EUR/USD stays under bearish pressure and trades at its lowest level since December 2022 below 1.0350 on Thursday. The pair turned south amid a resurgent US Dollar demand and worsening market mood. Investors stay cautious at the onset of 2025, awaiting the US jobs data for fresh incentives.

GBP/USD slumps to multi-month lows below 1.2450

Following an earlier recovery attempt, GBP/USD reversed its direction and declined to its weakest level in nearly eight months below 1.2450. The renewed US Dollar (USD) strength on worsening risk mood weighs on the pair as markets await mid-tier data releases.

Gold benefits from risk aversion, climbs above $2,640

Gold gathers recovery momentum and trades at a two-week-high above $2,640 heading into the American session on Thursday. The precious metal benefits from the sour market mood and the pullback seen in the US Treasury bond yields.

XRP rockets 11% as Bitcoin starts New Year with bullish bang

Crypto majors zoomed higher in the past 24 hours as the market entered a widely expected bullish year, with Bitcoin inching above $95,000 to shake off losses from last week. XRP surged 11% to lead growth among majors as of Thursday, led by $1.3 billion worth of trading volumes on Korea-focused exchange UpBit.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.